Phase 1 Trade Deal Unravels Despite Surging Chinese Crude Imports

Key Developments:

- Trade data show total U.S. energy purchases by China surging to $1.12 billion in May, a near five-fold increase from April.

- Over the first five months of 2020, the U.S. has only exported $1.73 billion of U.S. energy to China. This is just 6% of the energy purchases needed to meet the terms of the “Phase 1” trade deal.

- Ursa Space Systems satellite imagery data show onshore Chinese crude stocks pushing 57.1 million bbl higher since mid-May as imports have surged.

Since the first quarter, it has been our contention that two seemingly conflicting developments would happen simultaneously as we moved through the year:

- China would remain the most resilient importer and source of oil demand in the world amid the plunge in prices.

- China would fail to live up to the terms of the Phase 1 trade deal despite surging crude imports, further straining U.S.-China trade and political relations.

China has established itself as an opportunistic buyer and importer of crude amid market downturns over the past six years given both its vast and growing storage and refining capacities. Plummeting crude prices in March and April provided China a prime buying opportunity. And with China being the origin of the COVID-19 outbreak and the first nation to begin quarantine efforts, it also followed that China would also see refined product demand and refinery runs recovering well before nations in the West. This set the stage for the massive rebound in crude imports that has now been recorded for May and June. New official U.S. trade data show U.S. crude exports to China at a record high in May, and total U.S. energy exports to China at their third highest on record for the month. However, this new data continues to reveal China’s failure to live up to their U.S. energy purchase obligation as detailed in the Phase 1 trade deal. And as the hopes of further U.S.-China trade deals have unraveled, so have U.S.-China relations.

The latest official data from China’s General Administration of Customs show Chinese crude oil imports jumping 34% year-on-year in June, after already surging 19.2% year-on-year in May. May’s record-strong import pace of 11.3 million bpd was bested in June as imports rose to average 12.9 million bpd. At 12.9 million bpd, imports were up 33% from their eight-month low of 9.72 million bpd in March. Despite the drop in Chinese crude imports in March, first-half 2020 Chinese crude imports averaged 10% above year-ago levels.

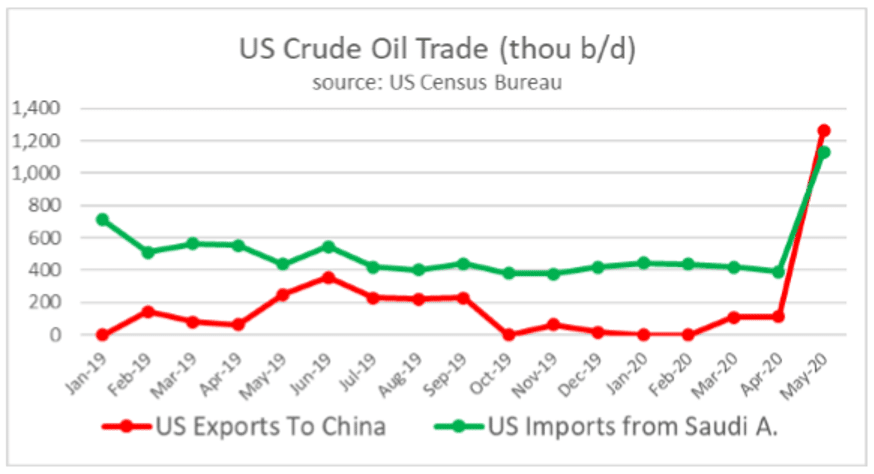

Although new arrivals of crude from China’s largest suppliers are likely to turn lower in the coming weeks given coordinated OPEC+ output cuts, imports of U.S. crude should push well higher in July. As we described in April, for U.S. crude producers, empty VLCCs are the key to ramping up export volumes. VLCCs are largely the only vessel used to ship U.S. crude to Asia, and amid high freight rates, a VLCC arriving in the U.S. Gulf Coast is unlikely to travel back to the Arab Gulf empty. The wave of VLCCs from the Arab Gulf bringing Saudi and Iraqi crude to the U.S. Gulf Coast in April and May opened the door for a wave of U.S. exports to East Asia. Indeed, U.S. Census Bureau data released earlier this month show U.S. imports of Saudi crude rising just under 800,000 bpd in May while U.S. crude exports to China rose just over 1.1 million bpd during the period.

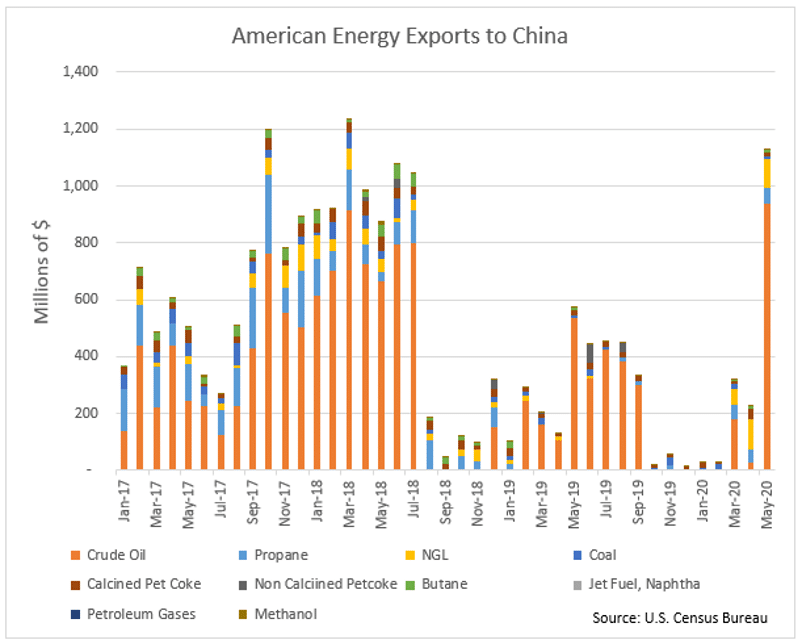

Official U.S. trade data show U.S. crude exports hitting their highest on record in both volume and dollar terms in May. U.S. crude exports to China were pegged at $938.2 million for the month, up from just $28.1 million in April. Driven by this surge in U.S. crude exports to China, total U.S. energy exports to China reached just over $1.1 billion in May–up from just $224.8 million in April. At $1.1 billion, U.S. energy exports to China were their third highest for any month on record and their highest since March 2018. Exports of butane, propane and coal to China were also all on the rise during May.

Despite the record strong U.S. crude exports to China in May and total U.S. energy exports hitting multi-year highs, China is still far from even beginning to meet the U.S. energy purchase obligation of the Phase 1 trade deal. In the first five months of the year, the U.S. has exported a total of $1.7 billion of energy commodities to China. This is just 6% of the $28 billion of purchases China is on the hook for this year if they are to meet the terms of the deal. To put this into context, even if China were to sustain purchases of U.S. energy commodities at May’s extremely strong $1.1 billion pace for the final 7 months of the year, China would have only met 34% of their 2020 quota at just over $9.6 billion.

In order to satisfy the energy portion of the Phase 1 trade deal, China would have to average U.S. energy purchases of $3.7 billion per month for the remainder of the year: $2.6 billion above May’s pace. Assuming purchases of other U.S. energy commodities remain at their elevated pace from May, and average price of crude of $40 bbl, crude exports to China would have to average 357,000 bpd above May’s pace for the remainder of the year, in order for China to meet their trade deal target. The probability of this happening is extremely low.

A major problem in this story is the mismatch in crude quality. Chinese imports of light-sweet crude grades like U.S. shale historically account for less than 1/10th of total imports given that Chinese refiners are primarily targeting greater middle distillate yield and are designed to process heavier and more sour crudes than those produced by U.S. shale producers. Exports of Mars crude from the Louisiana Offshore Oil Port (LOOP) have recently surged to record highs, given weak refinery runs in the U.S. and a tightening global medium-sour crude market amid record supply cuts from OPEC+ suppliers. Not only do heavier sour crudes make up but a fraction of total U.S. production, but it’s also highly unlikely that this recent strength in Mars crude exports will persist throughout the year if OPEC+ begins to loosen output cuts and premiums for Russian Urals and Arab Gulf sour grades begin to ease as we expect.

Even with the record-setting pace of Chinese crude imports in June, queues that formed offshore Shangdong for unloading oil tankers in May have continued to grow as new vessel arrivals outpace offtake amid port and infrastructure capacity constraints. According to Kpler vessel tracking data, floating storage volumes of crude offshore China quadrupled from the beginning of May to the beginning of July, swelling to 80 million bbls. Over that period, wait times to discharge at Chinese ports grew from an average of three to 12 days. The longer wait times off the China shore mean costly demurrage expenses for shippers, and have been attributed to rising VLCC freight rates in recent weeks as a major portion of global VLCC capacity is incapacitated.

Logistical constraints causing crude to backup offshore may also reflect narrowing onshore crude storage capacity at key storage hubs in close proximity to independent refiners. Ursa Space Systems satellite imagery data show Chinese crude inventories growing steadily since pulling back briefly in early May. China’s crude inventories have risen in seven of the past eight weeks. Crude stocks are now pegged at nearly 954 million bbl, rising just over 57 million bbls since the week ending May 14.

The outlook for crude stocks in China should be one of continued builds as we work through July. Weak global demand for refined products has led Chinese product exports lower and onshore inventories of refined products in China higher in recent weeks. As a result, refining margins are turning lower in China once again, and independent refiners are expected to cut runs by around 400,000 bpd over the July-August period.

As we expected, China has led global oil demand and import growth in the wake of the COVID-19 crash. However, it now appears as though the crude market will be increasingly dependent on other global sources of demand to recover in order to keep the rally in crude prices alive. The record strength in Chinese crude imports has supported crude prices over the past three months, but this has merely brought forward or frontloaded much of China’s 2020 import demand. China can now sit back and chip away at cheaply acquired stocks if crude prices push higher and await the next potential downturn to load up again.

Over the past few weeks, we have seen the Trump administration battling with China in nearly every way possible other than a hot war. While presidential economic advisor Larry Kudlow continues to argue that the Phase 1 deal is “intact,” last week President Trump said he is not focused on a possible Phase deal, adding that the relationship with China has been “severely damaged” by the COVID-19 pandemic. Tensions continue to rise as China’s new national security law that effectively dissolves the Hong Kong “one country, two systems” principle has led the U.S. to strip Hong Kong of its preferential trading status and implement sanctions. This comes as the U.S. rejects China’s claims in the South China Sea, raising the possibility of an actual shooting war replacing the current trade war.

We continue to forecast that China’s inability to meet the terms of the Phase 1 trade deal will become increasingly obvious to both the Trump administration and markets as we progress through the year. With a U.S. presidential election quickly approaching and an American voting base that appears willing to accept further escalation of U.S.-China hostilities in the wake of the COVID-19 pandemic, we should expect U.S.-China tensions to persist. Rising trade tensions between the world’s two largest economies amid a pre-existing global recession gives us little cause for oil demand optimism in the second half of the year.

Comprehensive weather insights help safeguard your operations and drive confident decisions to make everyday mining operations as safe and efficient as possible.

Comprehensive weather insights help safeguard your operations and drive confident decisions to make everyday mining operations as safe and efficient as possible. Learn how to optimize operations with credible weather and environmental intelligence. From aviation safety to environmental compliance, our comprehensive suite of solutions delivers real-time insights, advanced forecasting, and precise monitoring capabilities.

Learn how to optimize operations with credible weather and environmental intelligence. From aviation safety to environmental compliance, our comprehensive suite of solutions delivers real-time insights, advanced forecasting, and precise monitoring capabilities.