New! Introducing Elementized Platinum Weather on DTN ProphetX. Learn how this new feature can accelerate your energy trading processes.

Make Better Energy Trades With Accurate Weather Data

New! Introducing Elementized Platinum Weather on DTN ProphetX. Learn how this new feature can accelerate your energy trading processes.

The global pandemic has caused millions of workers worldwide to rethink their goals, careers, and ambitions. If this describes your scenario, you may be looking for something new. Energy trading courses could be the key to unlocking a whole new career path for you.

When it comes to making effective decisions on when to buy or sell on the market, knowledge is everything. Using historical stock prices to predict market trends is an excellent way to understand when to buy and sell. Accessing information about past patterns, and using all available real-time tick data, are keys to trading success.

Our expert weighs in on why gasoline, diesel, and jet fuel are set to establish their own recovery paths.

In the middle of a global crisis, most people go into survival mode. The first thing on their minds isn’t whether or not it’s a good time for commodity trading. The majority need to focus on weathering the crisis and holding on to their jobs, homes, and future. But for those in the commodity trading

The impact of the COVID-19 outbreak has been felt all over the world. Schools have closed, travel plans have been put on hold and businesses large and small are bracing themselves for the continued fall out.

The dual pressures of the Saudi Arabia-Russia price war and COVID-19 have shocked the energy sector. In our webinar, industry expert Dominick Chrichella will explain the dynamics of the market, what to expect, and what you can do to reduce negative impact to your business.

DTN’s lead analyst Todd Hultman will evaluate USDA’s latest report estimates.

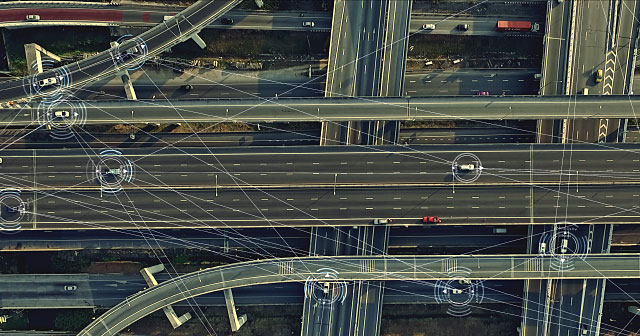

Real time traffic data suggests travel in America’s largest cities is down over 50% from their historical seasonal norms, which could lead gasoline demand to drop to its lowest in over 20 years.

Our market commentary highlights how commodity prices may hold at long-term support levels while equities and other risk assets may continue to trend lower.