A new AI solution identifies and predicts refined fuels market outcomes to reduce uncertainty and improve negotiations, pricing strategies, and better decisions.

Refined Fuels Market Prime for Predictive AI Solution

A new AI solution identifies and predicts refined fuels market outcomes to reduce uncertainty and improve negotiations, pricing strategies, and better decisions.

Refined Fuels Demand data from DTN complements EIA WPRS to inform oil and gasoline markets with a more accurate and timelier picture of current market demands.

Relying on the same standard reports as everyone else won’t secure you an edge in the fuels market. Digital demand data can.

Enhance your understanding of today’s global energy market with our must-read, comprehensive analysis and outlook of this dynamic sector.

New incentives for increased ethanol content are running into issues. Learn why and how it may impact the refined fuels market.

Renewable Fuel Standard mandates might change as the EPA responds to backlash. Learn how you could improve your market position.

With the official start of U.S. hurricane season upon us, learn why your margins could take a direct hit if you’re using weekly fuel demand reports.

A comprehensive view of the downstream market is critical for actionable, profitable decisions. Learn how you can achieve it with three types of data.

All the recession warning lights are blinking a bright red, but consumers are spending, and hiring remains strong. According to Brian Milne, data from past recessions and recoveries may not apply in this new world. See what he thinks lies ahead.

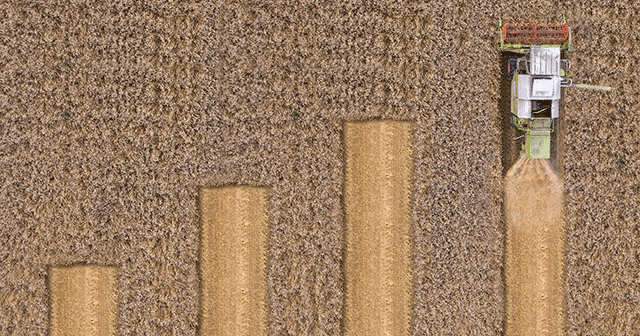

With so many grain contract options available and ever-changing crop prices, how can you determine which approach is right for you? Which grain contract will effectively balance risk management without sacrificing potential profit increases? Are accumulator grain contracts conducive to your marketing plan, or is a more straightforward minimum price contract the way to go?