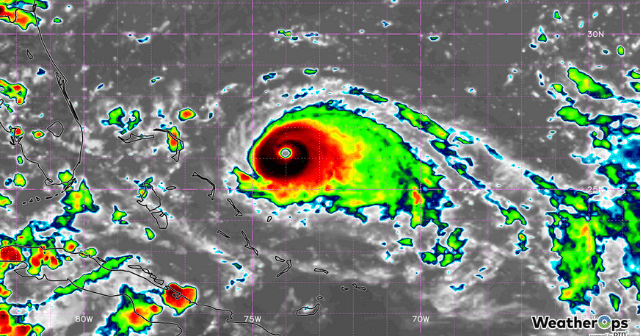

Category 2 Hurricane Dorian is moving north and influencing gasoline and diesel liftings and demand.

Dorian creates power outages, decline in gasoline demand

Category 2 Hurricane Dorian is moving north and influencing gasoline and diesel liftings and demand.

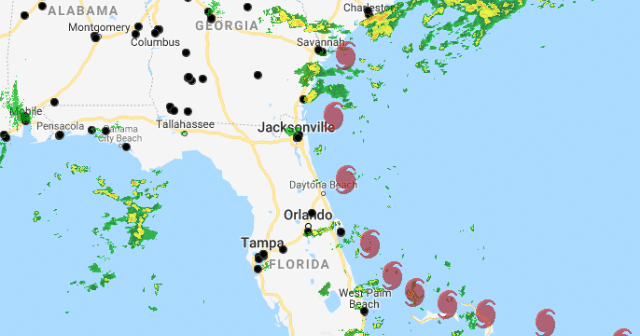

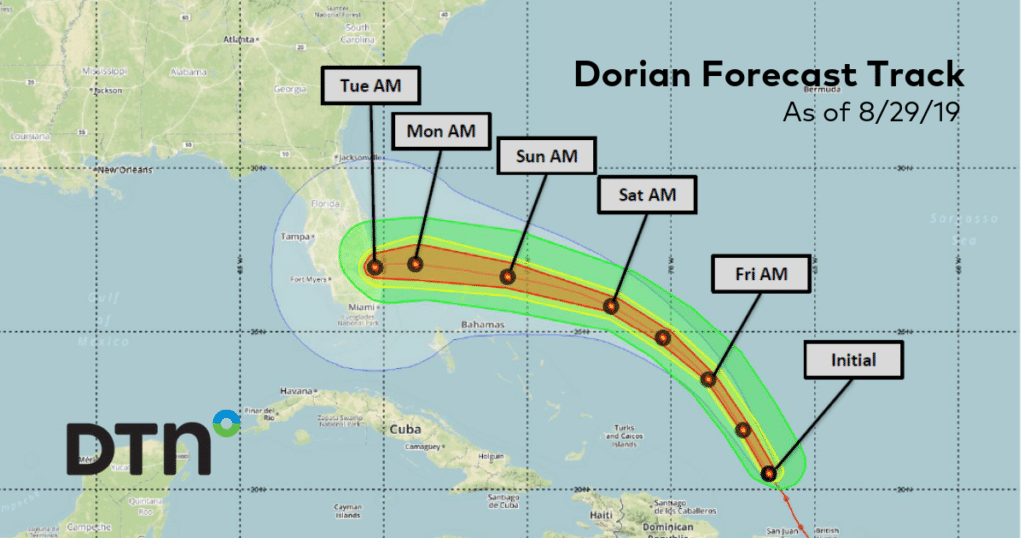

Hurricane Dorian is forecast to remain offshore as it passes Florida and Georgia approaching the Carolinas. Gasoline and diesel liftings that we are monitoring have started to decline except for Selma, N.C.

DTN expects Dorian will not make landfall in the United States at this time. Gasoline and diesel liftings of product from the terminals have started to decline except for Charleston.

The Category 4 Hurricane Dorian track is mostly in line with Sunday’s projections with the storm expected to hug the coast line putting Georgia and the Carolinas also in the cross hairs of the storm.

Hurricane Dorian continues to track off the coast of the U.S. Gasoline and diesel liftings at the terminals DTN is monitoring have started to decline (except for Savannah).

Liftings remain above normal in both Florida terminals. Prices are stabilized and only slightly higher. Wholesale prices seem to have flattened out and are now only slightly higher than where they were before the atypical lifting began.

Opportunistic gasoline prices spiked Friday in advance of Hurricane Dorian reaching landfall as Florida residents filled their tanks and possibly headed inland. The Orlando and Jacksonville charts, produced by DTN, reflect regular gasoline daily terminal liftings along with the wt. average rack price (solid blue line). The dotted line is a linear regression trend line.

Gasoline and diesel markets appear to be in good shape in advance of Hurricane Dorian reaching Florida shores. DTN is monitoring daily terminal volumes and prices once Dorian arrives and moves out.

Heading into the heart of the tropical storm season, we’re seeing that our gasoline supply and demand balances are very comfortable in the United States. That said, an active weather season could have significant impacts as storms develop in key geographic areas.

Even at current oil supply levels, current geopolitical issues will likely continue to cause tension in the market.