DTN Market Analyst Troy Vincent explains how the U.S. Energy Information Administration’s Product Supplied can send misleading signals in times of strategic inventory shifts.

Don’t Fall for Reported Gasoline Demand Surge

DTN Market Analyst Troy Vincent explains how the U.S. Energy Information Administration’s Product Supplied can send misleading signals in times of strategic inventory shifts.

-The range of expectations for September U.S. crude exports to China lies between 835,000 bpd and 1.2 million bpd. -Even the high-end estimate is still only roughly 1/3 of the volume needed to put China on track to meet the terms of the deal this year. – While new storage capacity additions will continue to

If there’s one thing that is certain in today’s oil market, it’s that uncertainty is near extremes. But the global fuel market shows signs of stabilizing.

When you are wading through all the data involved in making smart trades, timing is critical. Working with obsolete data will likely bring disastrous results. It’s imperative that you use real-time ticker data for your grain stocks trading.

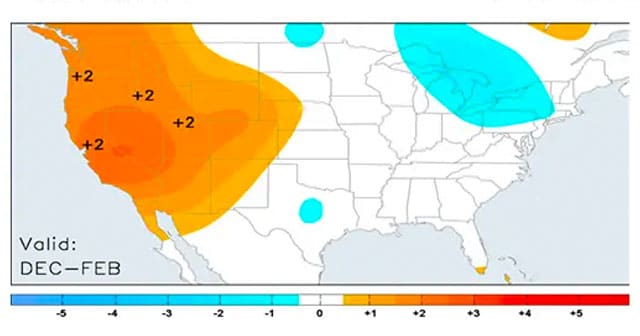

New! Introducing Elementized Platinum Weather on DTN ProphetX. Learn how this new feature can accelerate your energy trading processes.

Trading courses allow you to achieve your full potential and ensure industry experts take you seriously.

Lamb Fuels is credited with pioneering the fuel recovery market in the United States and Canada.

Crude prices have pushed higher this week despite Wednesday’s bearish fundamental data release by the EIA. So far this week, the plummeting U.S. dollar has overshadowed fundamental data which point to rising U.S. crude production and renewed weakness in demand amid the weight of the growing COVID-19 pandemic.

Learn why DTN Market Insights Director Dominick Chirichella says stabilizing oil rigs could signal a change in the markets — and what factors may stand in the way.

The global pandemic has caused millions of workers worldwide to rethink their goals, careers, and ambitions. If this describes your scenario, you may be looking for something new. Energy trading courses could be the key to unlocking a whole new career path for you.