Actual temperature of fuel matters. Why? It could cost you more than you realize. Get your FREE sample report to see how you’ll benefit from TCI.

“Best Estimate” Isn’t Good Enough

Actual temperature of fuel matters. Why? It could cost you more than you realize. Get your FREE sample report to see how you’ll benefit from TCI.

In the volatile, fast-paced U.K. fuel markets, managing risk is key. Our new blog focuses on three challenges suppliers face and how they can keep their focus, overcome common challenges, and drive stronger operations.

When it comes to the average consumer, the market price of a barrel of crude oil is no more than a vague indication of rising or falling gas prices. But for those who are involved in the oil and gas industry, oil prices have great significance: they directly impact our bottom lines.

Learn how fuel traders and buyers are leveraging APIs to create business efficiencies and increase revenue by reducing the friction within their internal processes and workflows.

In a competitive industry like oil and gas, understanding the impact even seemingly minor factors have on your profits is crucial. Incorporating advancements into your business operations to counter the effects of these factors is essential. In addition to dynamic pricing, advanced analytics, and market trends, something else can be easily overlooked but can make a substantial difference in profits: gross vs. net temperature.

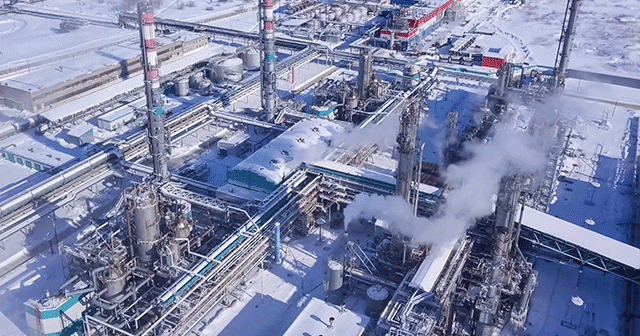

The oil and gas industry is one of the most complex industries in the world. It makes sense, therefore, that the oil and gas supply chain is equally complex. With so many different players in the industry, oil and gas companies are constantly working to innovate the supply chain. Companies want each piece to be more efficient for them as well as better for their customers at every stage of the process.

As businesses continue to look for ways to increase profitability, it stands to reason that they will take a look at their profit margins. While total sales and revenues are important to understand, profit margin is one of the best ways to get a clear picture of the financial health of your business.

Global energy supply issues — and the resulting higher prices — could make this winter more challenging for many. Explore the likely effects on U.S. fuel markets in Brian Milne’s latest article.

Although the 50 million additional barrels of crude the U.S. plans to add to the market amounts to the biggest release of oil in history, that is unlikely to sharply reduce gas prices, experts told CBS MoneyWatch.

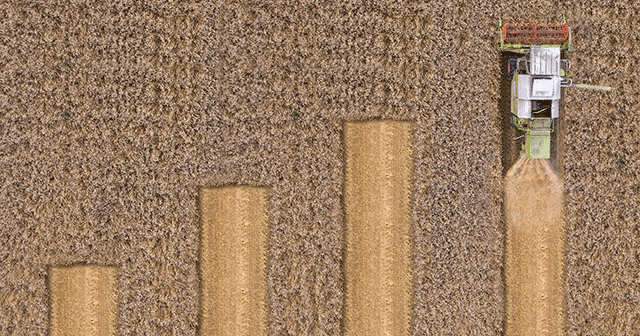

With so many grain contract options available and ever-changing crop prices, how can you determine which approach is right for you? Which grain contract will effectively balance risk management without sacrificing potential profit increases? Are accumulator grain contracts conducive to your marketing plan, or is a more straightforward minimum price contract the way to go?