Our webinar dives into our recent Forrester study to identify trends and concerns as the energy industry transitions away from legacy systems.

Learn how oil and gas will be impacted by digital modernization

Our webinar dives into our recent Forrester study to identify trends and concerns as the energy industry transitions away from legacy systems.

DTN Senior Market Analyst Troy Vincent discusses additional pressures and opportunities in the global energy market as more sanctions were imposed on Russia.

Downstream oil and gas is at a digital crossroads, and industry decision-makers feel the pressure. Discover the top three areas — revealed in a new commissioned study — where digitization can drive revenue, growth, and continuity across the supply chain.

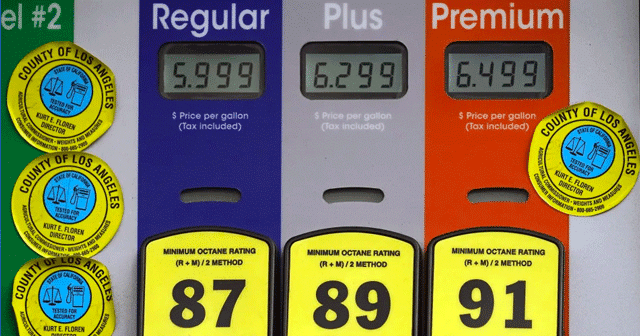

DTN editor Brian Milne told MarketWatch this is “ensuring American motorists will be paying more for gasoline at the pump, ” adding that gasoline prices will be at $3.75 per gallon by early next month.

New research from DTN and Forrester points to priorities in digitization and improvements in operational agility to help drive revenue and better protect business continuity along the oil and gas supply chain.

Learn about thermal expansion, and why it can threaten your profits. Read the white paper.

Energy and oil prices have been on fire over the last six months and DTN analyst Troy Vincent expects them to go higher.

We can compare the downstream fuel supply chain to an ecosystem. Many parts work together to form a lengthy, synergetic process. Like an ecosystem, each piece of the supply chain relies on the other parts to be effective. For example, the downstream supply chain includes buyers, suppliers, terminals, and carriers—each of these shares many of the same challenges.

Cost and revenue drivers vary slightly within the upstream, midstream, and downstream oil and gas sectors, as their functions are different within the industry. No matter where your business lies within the gas and oil industry stream, better decision-making begins with better intelligence.

If you sell fuel, you know the importance of good pricing decisions. Good pricing decisions do more than protect your profit margins. It improves the buying loyalty of your current accounts and improves the chances that you will be introduced to new buyers. However, your fuel pricing strategy does not just take into account what competitors are doing when it comes to fuel pricing strategies; it also considers what consumer trends exist and how the market is reacting to any changes.